Home Carer Tax Credit

You may be entitled to claim the Home Carer Tax Credit if you are married or in a civil partnership and you care for one or more Dependent Persons. So many people miss out on this tax credit due to not knowing the criteria or simply not knowing it is there. The following are the full details for claiming the tax credit and the rates of the credit for 2021.

Qualifying for the Home Carer Tax Credit:

Firstly, the Home Carers Tax Credit is tax relief for married couples who are jointly assessed for tax purposes, where one person stays at home to care for a Dependent Person.

A Dependent Person must be either:

- A child for whom you receive the child benefit payments

- A person aged 65 years or older

- A person who is permanently incapacitated due to mental or physical disability

The Dependent Person cannot be your spouse or civil partner but can be someone related to you by marriage or someone you are a legal guardian to.

The carer’s income must be less than €10,400 for the tax year 2021 to claim the credit.

Does the Dependent Person have to live in your home?

If you care for a dependent person who is a relative of yours, or of your spouse or civil partner, they need not live in your home. They must however live either next door in a neighbouring home, on the same property or within 2 kilometres of your home.

There must be a direct communication link such as a telephone or alarm system between your home and the home of the dependent person.

If you care for a person who is not a relative of either you or your spouse or civil partner, then they do have to live in your home.

Home Carer Tax Credit Rates:

The Home Carer Tax Credit rate for 2021 is a maximum of €1,600 where the carer’s income is less than €7,200.

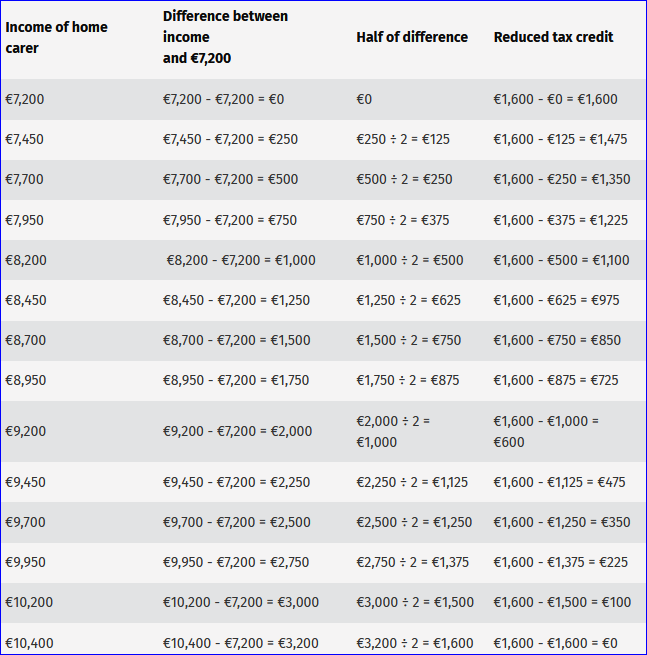

Where the Home Carer’s income is more than €7,200 but less than €10,400 then a reduced tax credit will apply. Please note that Carer’s Allowance is not included in calculating your income.

See the following table for the worth of the credit based on different levels of income:

Claiming the Home Carers Tax Credit:

By completing our simple Online Registration form, our team of Chartered Accountants will be able to review your taxes and ensure that you are claiming this Tax Credit if you are entitled to it. We review your taxes for the last four years and ensure you are claiming all your tax reliefs. We are here to get you YourMoneyBack.

If you have any questions on the above or if you just need help claiming YourMoneyBack, simply contact us today. Our team of Chartered Accountants will be happy to answer any of your questions. With our expertise we will ensure that you claim the maximum tax refund available and we our fees are the lowest in Ireland. Plus, if you are not due a tax refund then there is no charge. Simply complete our registration form at www.yourmoneyback.ie and we do the rest. Don’t miss your chance for a tax refund and Apply Today for YourMoneyBack!